Confidence. That’s the bedrock of any transaction involving something that maintains a value over time. Whether it is a bottle of rare single malt whisky, a Rolex or shares in a company, all but the most laissez-faire buyers will be mindful not just that the purchase price is appropriate, but also that the value won’t immediately plummet once the wrapping has come off. Cars, especially classic and collector vehicles, are no different.

As the UK Hagerty Price Guide editor, you’d expect me to say that car values are important. One of the main reasons we publish the Guide and update it quarterly is to give enthusiasts a modicum of confidence when they’re buying, selling, or just valuing their own cars. But this summer, Hagerty’s team tracking sales through dealers, auctions and online sales have spotted a trend: buyers’ confidence seems to be low. James Mitchell, of Pendine Historic Cars, explained the problem from a dealer’s perspective. ‘For as long as I’ve been in the business, I’ve had people come to talk to me who have reached the point in their lives when they’ve saved the money and found space in the garage to finally buy the car of their dreams,’ he said. ‘Recently, though, they just don’t go through with the purchase, and I believe it’s because they don’t know what the car’s real value is or where it will be in a year’s time. The trouble is, nobody knows.’

It’s no wonder that there are a lot of factors playing on buyers’ minds at the moment. The UK Consumer Price Index (CPI), although down from its 2022 peak, is still showing inflation rates that previously hadn’t been experienced for decades. ULEZ expansion, the creeping damnation of the internal combustion engine (ICE), reduced job security in many sectors and even the arbitrary decision-making of the DVLA all combine to make the future of the classic car world a tricky thing to forecast with accuracy.

There’s another issue, too, this time closer to home. This summer, public auction results, especially for live sales, have been interpreted by some commentators as marking a downturn in values that could foretell a more major correction. The headline figures don’t make for good reading. Comparing six major UK summer auctions, the mean sale price and sell- through rates are way down from the same sales in 2022, especially with more expensive lots. In Monterey, the August bellwether of the US market, it was the same story: the sell- through rate was down across all price brackets across all auctions.

But dig deeper, and there’s another factor in play. Hagerty compared average low estimates with average high bids, a great indicator of what the sellers’ expectations were compared with the buyers’ willingness to pay. There’s been a drop of nine percentage points over the six major UK auctions, year-on-year, a significant drop. But the even larger, 15% drop in no- reserve lots over the same period suggests that there is no desperation to sell.

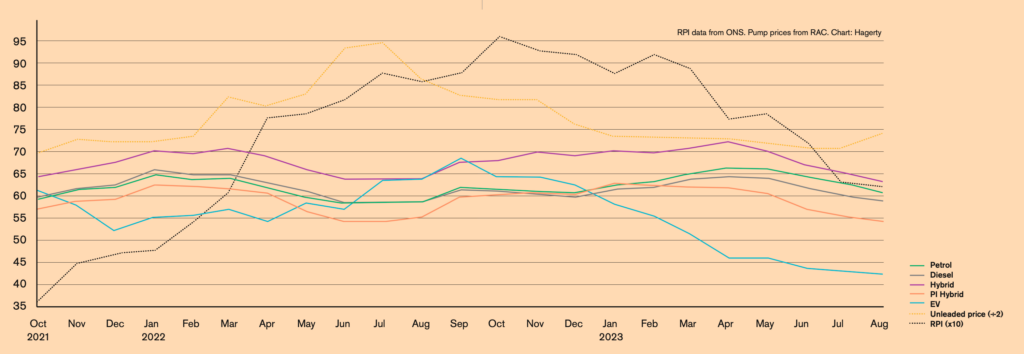

Residual values – UK used car residual values as percentage of list price. RPI rate (x10) and unleaded pump price (pence per litre inc VAT, x0.5) superimposed

Damian Jones, Senior Car Specialist at H&H Classic Auctions, believes that there is a disconnect between the values that vendors look at and consider relevant, and those that buyers compare. He said: ‘Typically, vendors look at similar sales over the past year or 18 months before they consign their car, but buyers tend to look at what else is on the market right now. In a rapidly changing market as we have at the moment, that can mean vendors’ expectations may not be reached by bidders’ willingness to pay.’

I believe that what we’re seeing is the result of the economic factors listed above combined with the difficulty everyone is having predicting what is going to happen politically, financially or legislatively next week, let alone next year. People are certainly being careful with their money, and buyers are tending to sit on their hands rather than take a risk on a car that, a few years ago, seemed like a dead-cert price riser. The continued booming of the historic restoration and event sectors show that there is no hesitance when it comes to spending money on your classic, but buying a new one at the moment can seem risky, or buyers are going for a cheaper car with less to lose. Sellers are also being careful, setting relatively high reserves to protect themselves.

The same pressures affect online auctions, but having more numerous vendors gives them a stronger position, as Car & Classic’s Tom Wood explained: ‘Prices across some sectors of the classic car market are not where they were three years ago and it’s taken vendors time to come to terms with that. With such strong supply, we are in the fortunate position to be able to turn away vehicles that are overpriced.’ There are some reassurances, however. Another similar area where confidence has left the market is in used electric vehicle (EV) sales. According to data published by Autovista, the average residual value of a used EV is now £43,508, just 43.6% of its original list price, a figure that was nearly 70% a year ago. The same data shows that dealers have EVs sitting on their forecourt for an average of 45.6 days compared with 36.6 for petrol cars, almost a complete reversal from October 2022; used EV values have dropped and are difficult to sell. In the classic car market, we haven’t seen anything like this seismic shift in consumer confidence, and Hagerty’s longer-term forecasts for the market remain good.

So, what’s the outlook? I believe that the market will remain uncertain for a while, as long as the wider world remains so uncertain – but all the indicators suggest that there’s no desperation to sell, which is something that traditionally tends to foretell a real dip in values. Of all Hagerty’s indices that track the market from many different angles, the Classic Index, the one that tracks 50 cars that represent the UK enthusiast market, has the steadiest trajectory. I believe that by spring 2024, those who wish to sell will probably have a more realistic view of what their car is worth, and price accordingly. In the meantime, those of us who provide price guide data will continue to do so as best we can.